Clear your shipment with DHL Express

Your shipment is waiting to be cleared through customs. In the advisory email we described what you need to do to make sure this one gets to you.

We asked you to visit this page because you need to:

- know the instructions below

- verify on their basis that the documents you hold are correct

- write to us in reply to the notification e-mail confirming that the documents are correct or send additional information as instructed below.

How does the DHL Express customs process look like?

Correct and complete documents are most important for smooth customs clearance. Complete informations allows us to process clearance without contacting you. In some cases we will need to complete the information – then we will contact you.

Check that your invoice has the correct information

Check that your invoice has the correct information

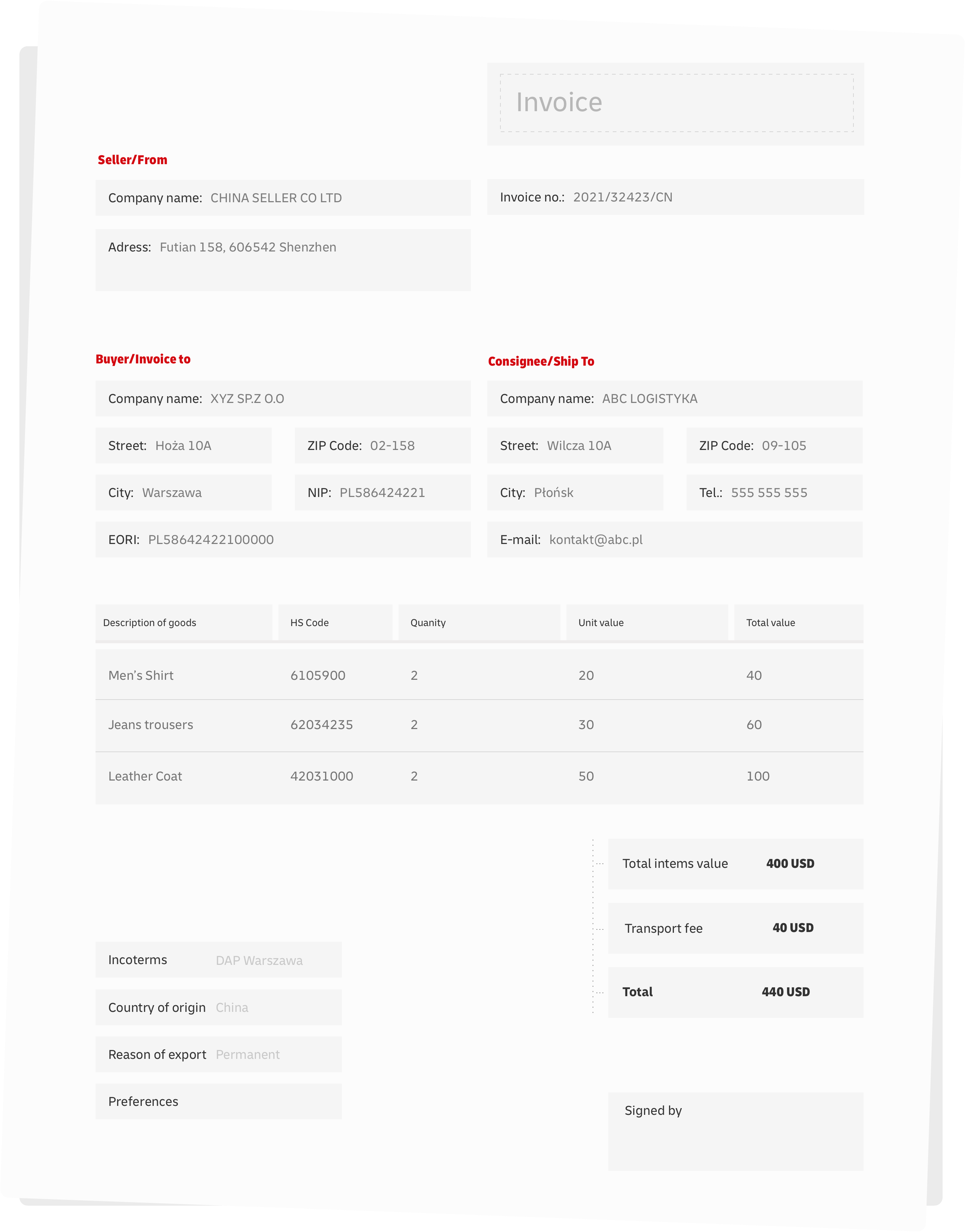

Below you can see a sample of the invoice that usually accompanies your shipment and enables customs clearance. Compare if the information on the invoice accompanying your shipment is correct and described exactly as below.

If any of the items on your invoice are incorrect, be sure to let us know in your reply to the email our customs agency sent you. Please also send us additional information on this subject. What kind of information? We have described this for each point.

Document name / number

The name of the invoice is based on the nature of the business transaction. In the case of:

- Buy-sell transactions. The document should be named: commercial invoice / invoice. Check if the name of your invoice corresponds to the transaction. If not, send us the correct invoice or the appropriate statement (download).

- Free transfers of goods or when the content are samples / specimens, the document should be named: proforma invoice / proforma invoice / non commercial invoice. Check if the name of your invoice corresponds to the transaction. If something is wrong, send us a correct invoice or a completed declaration (download).

Invoice number

The document usually has a number, but it is not critical to clear customs.

If for some reason these details are important to you, please verify their accuracy. In case of errors, send us the correct invoice.

Seller information

Check that the sender details are correct on your invoice.

If not, please send us:

- correct invoice, or

- statement of shipper’s data change (download).

Please note the delivery address. If there is a difference between your company’s registered address and the address listed on your invoice, please send us this statement (download).

Detailed description of the goods

Send us a description of the goods in Polish. You can do it by replying to the notification e-mail.

The description should include the following information:

- What is it? What is the product?

- What is it made of?

- What is it used for?

May include serial number or other markings/identifiers.

Example of translation:

T-shirt 100% cotton,

brake discs, 100% steel, for a passenger car,

wood lathe SN:128741, steel

Tariff code

The tariff code (more about tariff code) on the invoice is helpful in determining the duty rate for the goods. If you know the tariff code, you can send it to us. If you don’t know the code, a detailed description of the item is important. If you don’t know the code, an exact description of the item is important (item 5).

Quantity

We need to know what quantity of goods is in the shipment. Here it is necessary to mark the appropriate unit of measurement.

For example:

- 100 pcs.

- 25 kg

- 10 m2

If the quantity does not match, send us a correct invoice

Unit value

Check that: quantity matches the value on the invoice.

If the amount does not match contact the shipper/seller and then send us a corrected invoice.

Total value of goods

Verify that all items on the invoice are correctly calculated (price x quantity). None of the items on the invoice can have a value of 0. If there is a calculation error, please send us a correct invoice.

Transportation cost

Verify that the shipping cost value on your invoice is correct.

When:

- the transport of the shipment was paid during the purchase, this information should be on the document.

- you do not know the value of transport costs, they will be assumed according to IATA statistical rates. In this situation:

- you do not need to take any action if you accept the costs

- send us an invoice with specified and correct shipping costs, if you do not accept the costs

Transport costs for customs clearance can never be “0”.

Total invoice value and currency code

Verify that the invoice/order has a 3-letter code for the currency in which the transaction took place. Example: USD, GBP, NOK, CHF, EUR, PLN.

If on documents:

- There is only a symbol e.g. $, £, €, ¥, 元, ask the sender to re-issue the invoice, or

- send us a statement (download)

Verify that the correct Incoterms terms are on the invoice

The correct designation is: three letter code + city name e.g: DAP WARSAW, EXW LONDON.

If it is incorrect, please send us:

- correct invoice, or

- statement (download)

Important! If on the invoice there is:

entry with specified transport amount 0 (zero) the statement will not be honored

e.g. Incoterms EXW then we cannot state that the conditions are DAP Katowice (this is a contradiction)

Check the correctness of the country of origin information, if this information is on the document. In case of error and when this information is important to you, send us a correct invoice.

Type of transaction

Check if the correct type of transaction has been declared.

If we do not receive this information from you and do not find it on the invoice, we will assume a release procedure for customs clearance.

Provide us with evidence of this if your goods are subject to the preferential origin rules. More details

Document name / number

The name of the invoice is based on the nature of the business transaction. In the case of:

- Buy-sell transactions. The document should be named: commercial invoice / invoice. Check if the name of your invoice corresponds to the transaction. If not, send us the correct invoice or the appropriate statement (download).

- Free transfers of goods or when the content are samples / specimens, the document should be named: proforma invoice / proforma invoice / non commercial invoice. Check if the name of your invoice corresponds to the transaction. If something is wrong, send us a correct invoice or a completed declaration (download).

Invoice number

The document usually has a number, but it is not critical to clear customs.

If for some reason these details are important to you, please verify their accuracy. In case of errors, send us the correct invoice.

Seller information

Check that the sender details are correct on your invoice.

If not, please send us:

- correct invoice, or

- statement of shipper’s data change (download).

Please note the delivery address. If there is a difference between your company’s registered address and the address listed on your invoice, please send us this statement (download).

Detailed description of the goods

Send us a description of the goods in Polish. You can do it by replying to the notification e-mail.

The description should include the following information:

- What is it? What is the product?

- What is it made of?

- What is it used for?

May include serial number or other markings/identifiers.

Example of translation:

T-shirt 100% cotton,

brake discs, 100% steel, for a passenger car,

wood lathe SN:128741, steel

Tariff code

The tariff code (more about tariff code) on the invoice is helpful in determining the duty rate for the goods. If you know the tariff code, you can send it to us. If you don’t know the code, a detailed description of the item is important. If you don’t know the code, an exact description of the item is important (item 5).

Quantity

We need to know what quantity of goods is in the shipment. Here it is necessary to mark the appropriate unit of measurement.

For example:

- 100 pcs.

- 25 kg

- 10 m2

If the quantity does not match, send us a correct invoice

Unit value

Check that: quantity matches the value on the invoice.

If the amount does not match contact the shipper/seller and then send us a corrected invoice.

Total value of goods

Verify that all items on the invoice are correctly calculated (price x quantity). None of the items on the invoice can have a value of 0. If there is a calculation error, please send us a correct invoice.

Transportation cost

Verify that the shipping cost value on your invoice is correct.

When:

- the transport of the shipment was paid during the purchase, this information should be on the document.

- you do not know the value of transport costs, they will be assumed according to IATA statistical rates. In this situation:

- you do not need to take any action if you accept the costs

- send us an invoice with specified and correct shipping costs, if you do not accept the costs

Transport costs for customs clearance can never be “0”.

Total invoice value and currency code

Verify that the invoice/order has a 3-letter code for the currency in which the transaction took place. Example: USD, GBP, NOK, CHF, EUR, PLN.

If on documents:

- There is only a symbol e.g. $, £, €, ¥, 元, ask the sender to re-issue the invoice, or

- send us a statement (download)

Verify that the correct Incoterms terms are on the invoice

The correct designation is: three letter code + city name e.g: DAP WARSAW, EXW LONDON.

If it is incorrect, please send us:

- correct invoice, or

- statement (download)

Important! If on the invoice there is:

entry with specified transport amount 0 (zero) the statement will not be honored

e.g. Incoterms EXW then we cannot state that the conditions are DAP Katowice (this is a contradiction)

Check the correctness of the country of origin information, if this information is on the document. In case of error and when this information is important to you, send us a correct invoice.

Type of transaction

Check if the correct type of transaction has been declared.

If we do not receive this information from you and do not find it on the invoice, we will assume a release procedure for customs clearance.

Provide us with evidence of this if your goods are subject to the preferential origin rules. More details

Frequently Asked Questions

An authorization is a type of power of attorney that allows us to represent companies or individuals before Customs.

The original of the completed document should be sent to the Customs Agency.

We must clear the shipment with the correct recipient’s data in accordance with the authorization (KRS, CEIDG), which the importer has given to represent him before the Customs Office. Therefore, if an invoice states a different address than the company’s registration data, a statement on address discrepancy is needed.

Dues exemptions are possible for:

- samples from a company to a company of less than €150 sent with a proforma invoice bearing the indication SAMPLE

- gifts from a private individual to a private individual of up to EUR 45 sent with a proforma invoice that includes the indication GIFT

The sender generating the import invoice very often gives too general names of goods or enters only product numbers. If this information is not sufficient for the Customs Office then we ask you to translate the content. This allows the Customs Agent to make a correct tariff classification of the goods.

The commission is a fee listed in our price list. It applies to clearance for entrepreneurs and/or natural persons for shipments with a value of more than 1000 EUR (based on authorization). Entrepreneurs are exempt from the commission in the case of bulk sample clearance (without a separate SAD).

The data correction fee for customs clearance is charged when:

- the invoice enclosed by the shipper was not correct in value

you received an invoice with different value of goods

However, if the amount on the new invoice does not differ due to the value of the goods, but is different due to additional costs, e.g. transport, then the fee is not charged.

Sometimes we need additional information to complete customs formalities for you. Remember: if you import goods from outside the European Union, you become an importer and your shipment is subject to customs clearance.

This happens by the 4th day of the following billing month.

Contact us if a post-clearance correction is required. After verification of the new documents, we can submit a request for correction of the customs declaration to the Customs Office.

The service is charged 226 PLN net in case of customer’s mistake. In case of DHL’s mistake we do not charge any fees. Customs Office has 90 days to issue the decision from the date of the application.