UNDERSTANDING THE URGENT IMPORTANCE OF COMPLIANCE AND ELECTRONIC DATA QUALITY.

It is critically important that your business complies with Customs Regulations and

Clearance processes and that you are aware of the upcoming European Regulatory

Changes.

Conforming to these new regulatory changes will enable you to:

| Aid consignments | Blankets, medications |

| Apparel | Men’s shirts, lingerie, girls’ vests, boys’ jackets |

| Appliances | Blankets, medications |

| Auto parts | Automobile brakes, windshield glass for automobiles |

| Machine parts | Pumps, seals, engines |

| Machinery | Metalworking machinery, cigarette-making machinery, sewing machines, printing machines |

| Machines | (See examples for "Machinery") |

| Oil | Mineral oil, plant oil |

| Plastic goods | Plastic kitchenware, plastic houseware |

| Electronics | Computers, televisions, CD players, tape recorders, mobile phones, monitors, printers |

| Equipment | Oil well equipment, poultry equipment |

| Foodstuffs | Fish, Beverages, Milk Powder |

| Gifts | Dolls, remote-control cars |

| Household goods | Plates, dishes, tableware (See also examples for "appliances") |

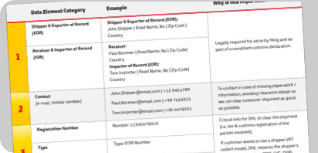

| Data Element Category | Example | Why is this important? | |

|---|---|---|---|

|

1

|

Shipper & Exporter of Record (EOR) | Shipper & Exporter of Record (EOR): John Shipper | Road Name, No | Zip Code | Country | Legally required for security filing and as part of a compliant customs declaration |

| Receiver & Importer of Record (IOR) | Receiver: Paul Receiver | Road Name, No | Zip Code | Country Importer of Record (IOR) Tom Importer | Road Name, No | Zip Code| Country |

||

|

2

|

Contact (e-mail, mobile number) |

John.Shipper@email.com | +12 3456789 Paul.Receiver@email.com | +98 7654321 Tom.Importer@email.com | +45 6478391 |

To contact in case of missing paperwork / information, avoiding clearance delays so we can clear customer shipment as quick as possible |

|

3

|

Registration Number | Number: 12345678910 |

Critical info for DHL to clear the shipment (i.e. tax & customs registration of the parties involved). If customer wants to use a shipper VAT collect model, DHL requires the shipper’s VAT Registration (e.g. IOSS, LVG, OSR), otherwise VAT potentially is charged twice. |

| Type | Type: EORI Number | ||

| Issuing country | Issuing Country: Belgium | ||

|

4

|

Type (Business / Private) | Type: Private or Commercial , B2C or B2B | For compliant customs clearance and to ensure the correct Deminimis threshold and duty exemptions are applied |

| Reason for Export | Reason for Export: Repair and Return | ||

|

5

|

Line Item Goods Description | Sunglasses with lenses optically worked | Legally required for security filing and as part of a compliant customs declaration |

| Line Item HS Code for Export / import Line | 9004.10.XXXX* (*last digits are country-specific) | ||

| Item Country of Origin | China | ||

| Line Item Quantity and Measure | 3 units (sunglasses) | ||

|

6

|

Goods Line Item Value & Currency | Goods Line Item Value: US$150 (x 3 units) | Legally required for as part of a compliant customs declaration |

| Total Other Monetary Amount | Insurance: US$ 25 | ||

| Total Freight Value & Currency | Total Freight: US$ 50 | ||

| Total Invoice Value & Currency | Total Invoice: US$ 525 | ||

| Incoterm and Place | Incoterm: EXW Place: Shanghai / China | ||

|

7

|

Total Gross Weight & Unit | 0.5 kilograms (KG) | Legally required for security |

|

8

|

WB Number | Goods Line Item Value: US$150 (x 3 units) | Legally required for compliant customs declaration |

| Customs Document Date Customs Document | Customs Document Date: July 22nd 2020 | ||

| Type and ID | Type: Commercial Invoice | ID: 98765543 |

| Samples | Samples of curtains (including drapes) and interior blinds; curtain or bed valances of cotton HS Code: 6303.91.XXXX (last digits are country-specific) |

| Parts | Parts of pumps for liquids, whether or not fitted with a measuring device; liquid elevators HS Code: 8413.91.XXXX |

| Gifts | Sunglasses with lenses optically worked HS Code: 9004.10. XXXX |

| Textiles | T-shirts made of cotton, knitted or crocheted HS Code: 6109.10. XXXX |

MyDHL+

Ideal for one shipment or many, this is an online portal that enables you to use just a single login to import, export, track shipments and much more – anywhere, anytime.

MyDHL API & Electronic Data Interchange (EDI)

Useful for large shipping volumes and multi-site logistics operations, this option fully integrates shipping into your existing global business processes.

EasyShip

Desktop Solution for large shipment volumes, multi-national supply chains and/or companies with a central shipping function.

Express Logistics Platform (ELP)

Online application for forward- and reverse-flow logistics (shipment handling with multiple legs).

Emailship

A suite of reusable DHL forms and step-by-step instructions that have been specially designed to enable quick and easy shipping using only your email (supports limited connectivity).

In 2021, major regulatory changes will take place in Europe. The European Customs authorities are further enforcing the regulatory requirements related to the provision of complete and accurate Customs data. To avoid delays to transit time and clearance, as well as potential penalties, shippers will now be required to provide the EU with more detailed information about their shipments, prior to export.

Import Control System (ICS2): This new regulation (ICS2) will result in the need for certain data elements to be sent to the EU Customs authorities – prior to loading at the country of export on a flight into or transiting the EU, Norway or Switzerland. For additional information, please consult the European Commission website below: https://ec.europa.eu/taxation_customs/general-information-customs/customs-security/ics2_en

VAT De Minimis Removal: The EU will abolish De Minimis levels for imports into the EU (currently EUR 22 in the majority of the EU Member States). Therefore, all shipments imported to the European Union (EU) will require a formal Customs declaration, and VAT will be levied.

For additional information, please consult the European Commission website below: https://ec.europa.eu/taxation_customs/business/vat/modernising-vat-cross-border-ecommerce_en

Have a complete understanding of these new European Customs regulatory changes and how they will impact you and your customers Ensure all Goods Descriptions on your DHL waybills are complete, accurate and meet the new requirements Be certain your Commercial Invoice data is being electronically transmitted to DHL. Meet with any relevant stakeholders (i.e. your IT team) to make this determination If you have any questions or are not yet providing DHL Express with complete and accurate Commercial Invoice data electronically, please contact your sales representative or the DHL Electronic Shipping Solutions Team to learn more about the options available to your business

.tg {border-collapse:collapse;border-color:#ccc;border-spacing:0;} .tg td{background-color:#fff;border-color:#ccc;border-style:solid;border-width:0px;color:#333; font-size:14px;overflow:hidden;padding:10px 5px;word-break:normal;} .tg th{background-color:#f0f0f0;border-color:#ccc;border-style:solid;border-width:0px;color:#333; font-size:14px;font-weight:normal;overflow:hidden;padding:10px 5px;word-break:normal;} .tg .tg-0pky{border-color:inherit;text-align:left;vertical-align:top}

| Unacceptable Example | Acceptable Example |

|---|---|

| Apparel | Mens shirt, Lingerie, Girls Vest |

| Electronics | Comuputers, Televisions, CD Player, Tape Recorder |

When preparing the Customs declaration, it is critical that all information submitted on the Commercial Invoice is complete and accurate, including (at a minimum) anything under the following categories:

Shipment Party information:

Shipment Content information

In addition, it’s essential that you provide any supporting documentation, such as permits, licenses or certificates (e.g. Certificate of Origin).

PLT will help us to receive the image of your Commercial Invoice more quickly, however we cannot extract the data elements from the image for Customs processing. We need to receive the data electronically.

Please contact your DHL Sales Representative to discuss the options available for your company to send us Customs data electronically.

Depending on the shipping system you use to create your shipments, there are different options for you to provide DHL Express with your Commercial Invoice data electronically – and preferably that will be sent together with your shipment data.

Please contact your DHL Sales Representative to discuss the options available for your company to send us Customs data electronically.

If you create a Commercial Invoice through our shipping systems, then yes, we can use that data to support the Customs Process. However, if you instead use your own, the Commercial Invoice must have a minimum set of data elements.

The Goods Description on the Commercial Invoice is an essential element used by DHL to prepare the Customs Declaration. In addition, it is critical to ensure that Goods Descriptions are accurate on the Waybill to help Customs authorities perform security/safety screening. For example:

.tg {border-collapse:collapse;border-color:#ccc;border-spacing:0;} .tg td{background-color:#fff;border-color:#ccc;border-style:solid;border-width:0px;color:#333; font-size:14px;overflow:hidden;padding:10px 5px;word-break:normal;} .tg th{background-color:#f0f0f0;border-color:#ccc;border-style:solid;border-width:0px;color:#333; font-size:14px;font-weight:normal;overflow:hidden;padding:10px 5px;word-break:normal;} .tg .tg-0pky{border-color:inherit;text-align:left;vertical-align:top}

| Unacceptable Example | Acceptable Example |

|---|---|

| Apparel | Mens shirt, Lingerie, Girls Vest |

| Electronics | Comuputers, Televisions, CD Player, Tape Recorder |

As of March 2021, if screening determines that the Goods Description data is not accurate, that shipment will not be allowed on the plane at origin, which will of course cause processing delays

There are multiple sources for finding HS Codes and product descriptions:

European TARIC website: https://ec.europa.eu/taxation_customs/dds2/taric/taric_consultation.jsp?Lang=en#

TAS (tas.dhl.com), you can search for the HS Code /Description based on the Goods Descriptions. After login, go to > TAS Resources > Interactive Classifier

Most countries have similar requirements, and as a result, Customs authorities are increasing their focus on enforcing compliance globally. Therefore, in order to avoid clearance delays, always be sure to send accurate Customs data to DHL, regardless of your shipment destination/origin.

With the VAT De Minimis Removal, the EU aims to level the playing field, protect its businesses and avoid unfair competition and distortion for EU companies.

Under current rules, imported goods bought from non-EU countries can be exempt from VAT if they cost less than €22. However, if products are purchased within the EU or in country, VAT is always levied, regardless of the value. The EU believes this exemption puts EU businesses at a disadvantage to non-EU businesses.

De Minimis The De Minimis threshold for Customs duties will not change, remaining €150.

Please see additional information related to VAT Modernization in Europe (with Specific focus on eCommerce):

https://ec.europa.eu/commission/presscorner/detail/en/MEMO_16_3746