Document name

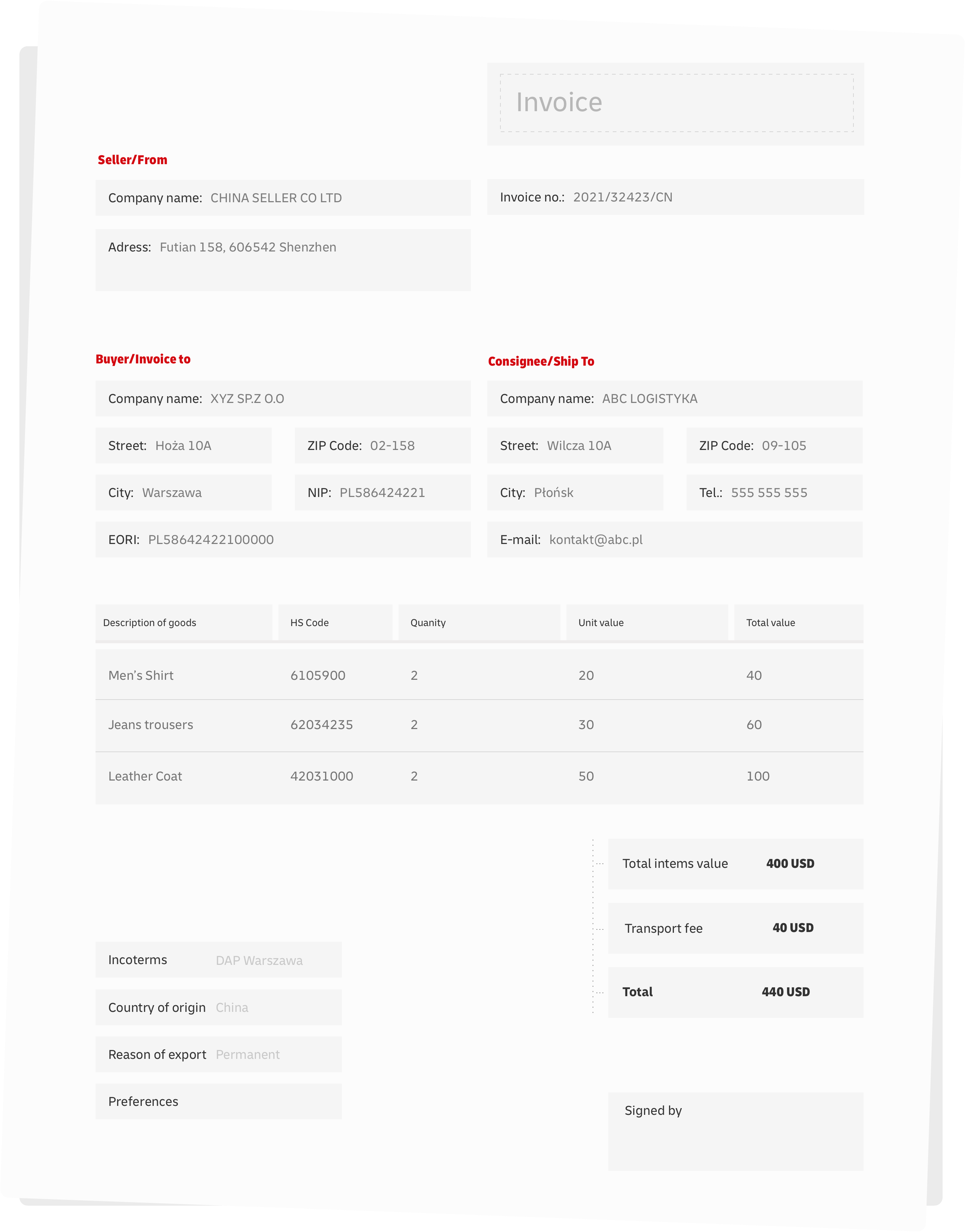

The invoice name is based on the nature of the business transaction.

In case of:

- purchase-sale transactions the document should be named: commercial invoice / commercial invoice / invoice

- free of charge transfer of goods or when the content are samples / specimens, the document should be named: proforma invoice / proforma invoice / non commercial invoice.