Document name is based on the type of transaction

-purchase-sale transaction: invoice/commercial invoice

-free shipping of samples and designs: proforma invoice/non-commercial invoice

Learn about the DHL Express customs process, so your shipments will clear customs smoothly.

From this page you will learn:

Correct and complete documents are the most important thing for a smooth customs clearance. A set of information and documents allows for efficient carrying out of the process. Pass them on to the courier and we will take care of the rest.

Under current law each and every shipment exported outside European Union has to be processed through customs. We will take care of all the formalities, however, we need the complete set of documents from you.

What documents? This depends on the type of the clearance and the procedure used.

You may learn what is exactly needed and in what kind of situation from our export dictionary. Check it out.

If your parcel does not qualify for the courier clearance or you asked for the individual clearance, we need you to authorize us to represent you before the customs and revenue authorities.

Here you will find all the information you need about authorization, forms and templates to fill out.

How to send us the authorization?

You will find the exact instructions on the first page of the authorization form.

To hasten the export customs clearance process you may also hand the original hard copy to our courier.

If you want to prepare an invoice or verify whether your invoice is correctly done, use the tool below

Go through the list below and familiarize yourself with all the points. In each you will find guidance on what should be in that section.

Document name

Document name is based on the type of transaction

-purchase-sale transaction: invoice/commercial invoice

-free shipping of samples and designs: proforma invoice/non-commercial invoice

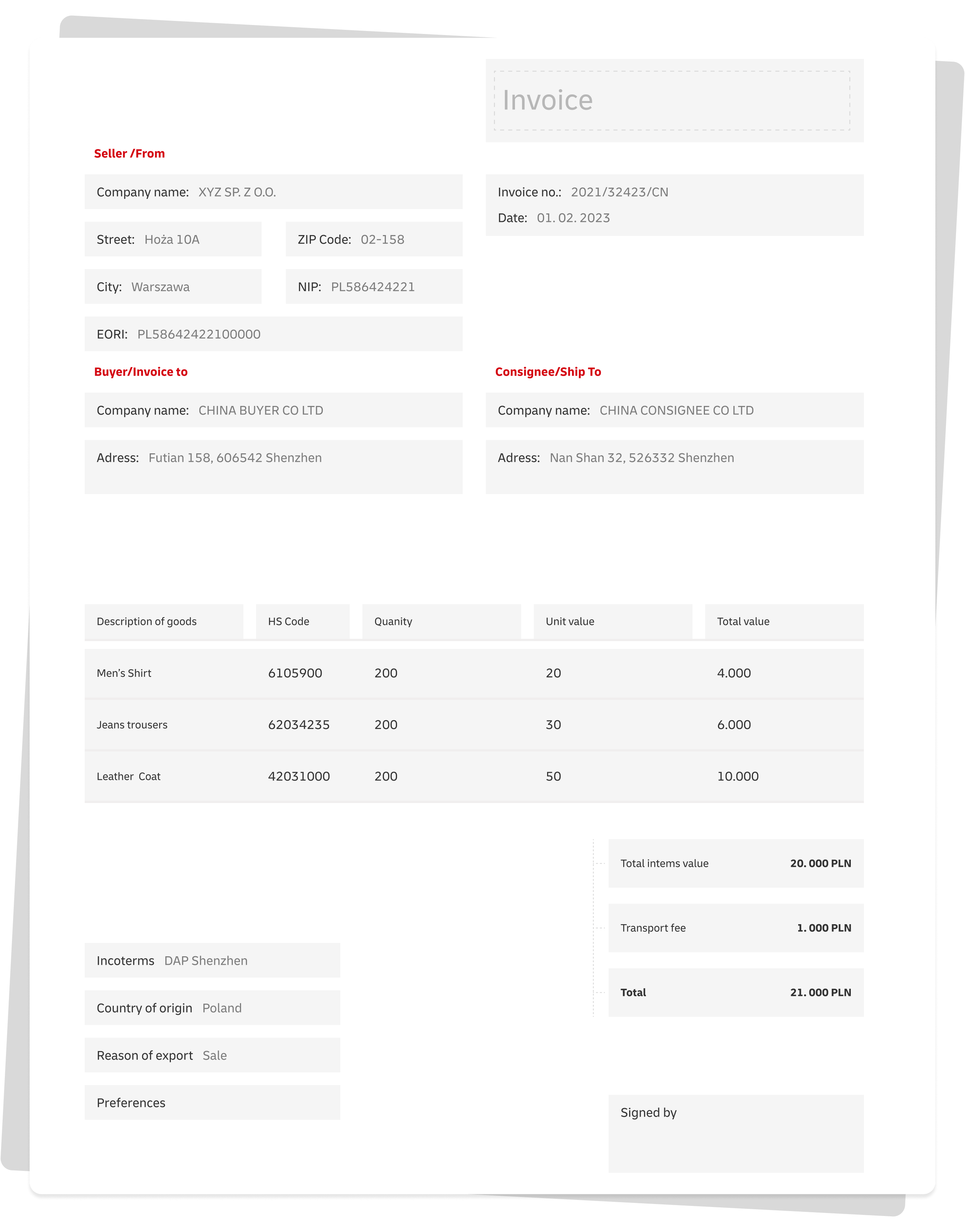

Seller/exporter details

The seller/exporter section ought to contain full, correct data of the exporter, sender or consignor (name of the company, address in line with the company registered head quarters address, NIP or/and EORI numbers)

What is EORI? You can learn about it here.

Invoice number

The document should have its own unique number and date of issue.

Buyer details/invoice to

The invoice should contain correct buyer’s details such as full name and address.

Consignee/Receiver

Full consignee’s/receiver’s data (can be the same as buyer’s).

Detailed description of the goods

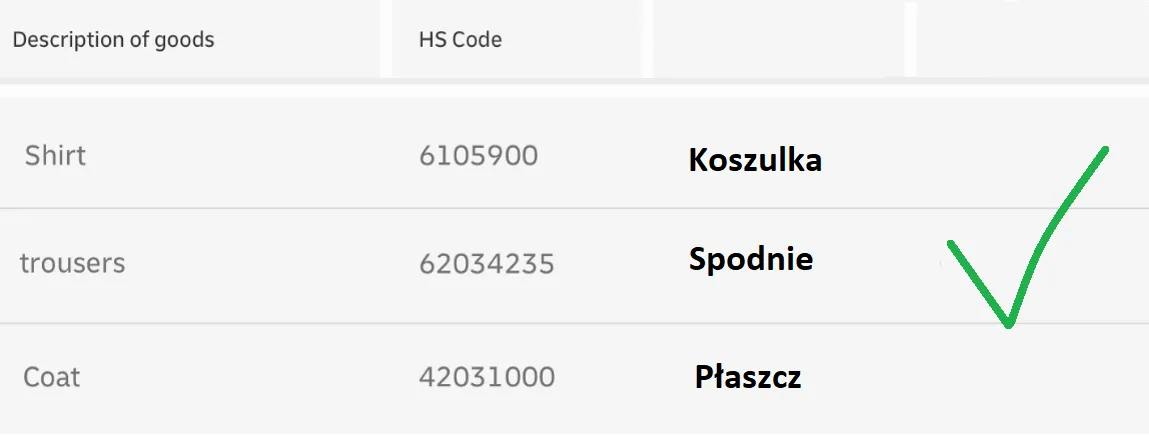

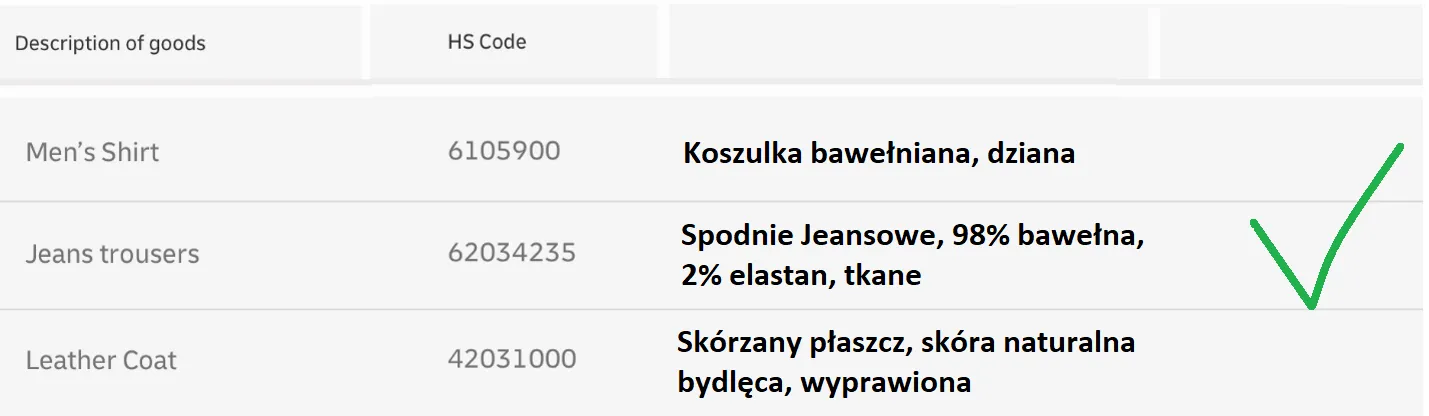

Description of goods/Translation

We expect you to provide us with an invoice in English, as this is the language used in the DHL network. Based on this, provide us with a description of the goods in Polish.

You can do this by writing it on the invoice you will give us for customs clearance, by including the description on the export clearance order, or by giving us the specification as an attachment to your documentation.

The description of the goods should include the following information:

WHAT IS IT?……….

WHAT IS IT MADE OF?……….

WHAT IS IT USED FOR/FOR WHAT DEVICE, EQUIPMENT?……….

SUGGESTED TARIFF CODE – if the goods have been cleared before (in case of lack of knowledge of the code the agent will match it by themselves).

The description can include serial numbers or other markings/identifiers. It is a key component for special procedures export customs clearance. Here, you may learn more about this subject.

Translation into Polish examples:

T-shirt 100% bawełna, 61059090

Spodnie jeansowe, 98% bawełna, 2% elastan, 62034235

Skórzany płaszcz, skóra naturalna, 42031000

Nowy, stalowy amortyzator samochodowy, 8708803590

Używany, stalowy siłownik hydrauliczny, 8412212090

Goods’ HS code

Goods’ HS code (The Harmonized System)

The customs tariff code will make it easier for us to correctly classify the shipment for the Customs authorities.

What is a customs tariff code? You can check here.

Quantity of goods

We need to know what quantities of goods are in the parcel. Here it is necessary to mark the appropriate unit of measurement. For example:

-100 pieces

-25 kg

-10 sq m

Unit price of the commodities

Unit price of the commodities

Total value of the goods

Verify that all items on the invoice have been converted correctly (price x quantity – price times quantity).

Transportation costs

The invoice needs to contain featured transportation costs or one of the INCOTERMS 2020 code/rule indicating who is the payer of the freight fees.

If freight costs have been paid when shipment was being sent, this information should be on the document along with the value of freight costs. If you do not provide them, we will calculate the statistical freight costs.

Total invoice value and three-letter currency symbol

It is the sum of the goods and freight values.

It should be the exact same as the value indicated on the waybill.

The important thing is the three-letter code of the currency in which you made the transaction (e.g. USD, GBP, PLN, EUR)

Terms of delivery/INCOTERMS 2020

International terms of trade INCOTERMS 2020

Term code + place/city, e.g. DAP Shenzhen, EXW Warsaw

When?

*transportation costs have been paid while sending the parcel – this information should be on the document(s) in the form of terms of delivery “DAP + place of delivery” along with the freight value.

*transportation costs are covered by the consignee – this information should be put on the document(s) in the form of terms of delivery “EXW + place of shipment”.

Country of origin

Indicating the correct country(ies) of origin allows for applying a preferential customs tax rate, if the customs laws in the destination country allow it.

In this regard, customs laws in each country are different. Therefore, before shipping get in touch with your counterparty to obtain information about what proofs of preferential origin are required.

Transaction type

A transaction type indicates the export purpose.

Two of the most common types are:

Samples – shipment of goods for which the consignor does not receive payment.

Sale – shipment of goods for which the consignor receives payment.

Others – you will find more information about those here, and about courier and individual clearance here.

Preferential customs tax rate

If the goods are subject to preferential origin rules, proof is required to apply preferential rates in the destination country. When and if they can be applied is determined by the destination country’s regulations.

In this regard, customs laws in each country are different. Therefore, before shipping get in touch with your counterparty to obtain information about what proofs of preferential origin are required.

Document name is based on the type of transaction

-purchase-sale transaction: invoice/commercial invoice

-free shipping of samples and designs: proforma invoice/non-commercial invoice

The seller/exporter section ought to contain full, correct data of the exporter, sender or consignor (name of the company, address in line with the company registered head quarters address, NIP or/and EORI numbers)

What is EORI? You can learn about it here.

The document should have its own unique number and date of issue.

The invoice should contain correct buyer’s details such as full name and address.

Full consignee’s/receiver’s data (can be the same as buyer’s).

Description of goods/Translation

We expect you to provide us with an invoice in English, as this is the language used in the DHL network. Based on this, provide us with a description of the goods in Polish.

You can do this by writing it on the invoice you will give us for customs clearance, by including the description on the export clearance order, or by giving us the specification as an attachment to your documentation.

The description of the goods should include the following information:

WHAT IS IT?……….

WHAT IS IT MADE OF?……….

WHAT IS IT USED FOR/FOR WHAT DEVICE, EQUIPMENT?……….

SUGGESTED TARIFF CODE – if the goods have been cleared before (in case of lack of knowledge of the code the agent will match it by themselves).

The description can include serial numbers or other markings/identifiers. It is a key component for special procedures export customs clearance. Here, you may learn more about this subject.

Translation into Polish examples:

T-shirt 100% bawełna, 61059090

Spodnie jeansowe, 98% bawełna, 2% elastan, 62034235

Skórzany płaszcz, skóra naturalna, 42031000

Nowy, stalowy amortyzator samochodowy, 8708803590

Używany, stalowy siłownik hydrauliczny, 8412212090

Goods’ HS code (The Harmonized System)

The customs tariff code will make it easier for us to correctly classify the shipment for the Customs authorities.

What is a customs tariff code? You can check here.

We need to know what quantities of goods are in the parcel. Here it is necessary to mark the appropriate unit of measurement. For example:

-100 pieces

-25 kg

-10 sq m

Unit price of the commodities

Verify that all items on the invoice have been converted correctly (price x quantity – price times quantity).

The invoice needs to contain featured transportation costs or one of the INCOTERMS 2020 code/rule indicating who is the payer of the freight fees.

If freight costs have been paid when shipment was being sent, this information should be on the document along with the value of freight costs. If you do not provide them, we will calculate the statistical freight costs.

It is the sum of the goods and freight values.

It should be the exact same as the value indicated on the waybill.

The important thing is the three-letter code of the currency in which you made the transaction (e.g. USD, GBP, PLN, EUR)

International terms of trade INCOTERMS 2020

Term code + place/city, e.g. DAP Shenzhen, EXW Warsaw

When?

*transportation costs have been paid while sending the parcel – this information should be on the document(s) in the form of terms of delivery “DAP + place of delivery” along with the freight value.

*transportation costs are covered by the consignee – this information should be put on the document(s) in the form of terms of delivery “EXW + place of shipment”.

Indicating the correct country(ies) of origin allows for applying a preferential customs tax rate, if the customs laws in the destination country allow it.

In this regard, customs laws in each country are different. Therefore, before shipping get in touch with your counterparty to obtain information about what proofs of preferential origin are required.

A transaction type indicates the export purpose.

Two of the most common types are:

Samples – shipment of goods for which the consignor does not receive payment.

Sale – shipment of goods for which the consignor receives payment.

Others – you will find more information about those here, and about courier and individual clearance here.

If the goods are subject to preferential origin rules, proof is required to apply preferential rates in the destination country. When and if they can be applied is determined by the destination country’s regulations.

In this regard, customs laws in each country are different. Therefore, before shipping get in touch with your counterparty to obtain information about what proofs of preferential origin are required.

Authorization for DHL is needed wherever individual customs clearance is performed. All the shipments over 1000 EUR and/or 1000 kg must obligatory go through individual clearance. In any other case the courier clearance which does not require authorization is possible. More information about the clearance types and needed documents can be found here.

Customs clearance order is in a way an instruction in what manner you want us to proceed with your package. Thanks to it, you have confidence the customs clearance will be done as you wish it.

If you do not send us an order, we will assume that you authorize us to choose the clearance type. We then proceed in two steps:

1. We clear the parcel through customs according to our knowledge and the documents received.

2. We contact you only when in doubt and if there is missing information in the documents. Priority in the chosen type of clearance is given to courier clearance.

We strongly urge you to always include an export clearance order with your documents or contact our Customer Service Department to verify the possibility of using a standing order.

Click here for more information on the export clearance order.

| Courier clearance | Individual clearance | |

|---|---|---|

| Authorization is required | NO | YES |

| EORI number is required | NO | YES |

| Technical description of the goods is required | NO | YES |

| Value of the goods | Up to 1000 EUR/1000 kg | Up to 1000 EUR/1000 kg and above |

| Concerns special procedures clearance | NO | YES |

| Invoice is required | YES | YES |

(*) Individual clearance

In case of individual clearance the export notifications are sent automatically to all the e-mail addresses included in the authorization given to us.

• For air freight transportation it takes usually between 2 and 5 business days

• For motor freight, most often between 5 and 15 business days

(*) Courier clearance

For shipments cleared through a courier clearance the export notifications are not sent automatically.

There are a few documents on the basis of which you can obtain confirmation of export, e.g. the tracking shipment history, confirmation of delivery to the receiver.

However, if you need an additional confirmation of courier clearance we can supply you with a relevant document at your request. How to receive it? Here you will find out more.

For more information on post-clearance documentation, click here.

We process the clearance according to the documents you provide. However, if you, for example, included an incorrect invoice, please let us know immediately. At your request we will prepare a document correcting the customs declaration. This is an additionally payable service in accordance with our Price List for International Services.

To order a correction of customs declaration, write us an e-mail at: PCM@dhl.com

stating the waybill number and attaching the correct documents, or contact our hotline 42 63 45 100.

| courier clearance – only general translation of contents required | individual clearance – detailed translation required | ||||

|---|---|---|---|---|---|

| Incorrect description | Correct description | Correct translation (into Polish) | Incorrect translation (into Polish) | Correct translation (into Polish) | Incorrect translation (into Polish) |

| Clothes | T-shirt | Koszulka | Ubrania | koszulka bawełniana, dziane | Koszulka |

| Clothes | Trousers | Spodnie | Ubrania | Spodnie Jeansowe, 98% bawełna, 2% elastan, tkane | Spodnie |

| Clothes | Coat | Płaszcz | Ubrania | Skórzany płaszcz, skóra naturalna bydlęca wyprawiona | Płaszcz |

| Parts | Damper | Amortyzator | Części | Nowy, stalowy amortyzator samochodowy | Części samochodowe |

| Parts | Hydraulic cylinder | Siłownik hydrauliczny | Części | Używany, stalowy siłownik hydrauliczny | Siłownik |

| Samples | Samples of plastic cover | Próbki osłon z tworzywa sztucznego | Próbki | Próbki osłon na rośliny ogrodowe z tworzywa sztucznego | Próbki |

Individual Clearance

Incorrect translation