Shipping can be accomplished in three ways:

1. Form INF 3

(Returning Goods)

Form INF 3

(Returning Goods)

Form INF 3 is used when you ship goods that are expected to be returned to you, e.g. sent to trade fairs, exhibitions or tests.

In this case INF 3 and the customs declaration are prepared by our Customs Agency, and you will receive an export confirming notification after clearance.

Using the INF 3 form results in a possibility to apply for import duties and taxes exemption, providing that the goods return to Poland within 3 years and in an unchanged state.

It is extremely important that the goods you ship are fully identifiable and traceable, so we need their serial numbers, model(s) or photos while shipping out.

To carry out the procedure we need:

- Invoice(s). You can find an example of a correct one here

- Your authorization for DHL Express to act as a representative (if you have not given us one before). The authorization form along with instructions can be found here

- Customs clearance order. Be sure to specify the purpose of the shipment. You can find the form

here

here - Information or documents confirming the identity of the goods

2. Temporary export, procedure 2300

This procedure is used when you ship goods that are expected to be returned to you, sent to e.g. trade fairs, exhibitions or tests.

In this case the customs declaration is prepared by our Customs Agency, and you will receive an export confirming notification after clearance.

Using this procedure results in a possibility to apply for import duties and taxes exemption, providing that the goods return to Poland within 3 years and in an unchanged state.

It is extremely important that the goods you ship are fully identifiable and traceable, so we need their serial numbers, model or photos while shipping out.

To carry out the procedure we need:

- Invoice(s). You can find an example of a correct one here

- Your authorization for DHL Express to act as a representative (if you have not given us one before). The authorization form along with instructions can be found here

- Customs clearance order. Be sure to specify the purpose of the shipment. You can find the form

here

here - Information or documents confirming the identity of the goods

3. The ATA Carnet

The ATA Carnet

The ATA Carnet is used when you ship goods that are expected to be returned to you, e.g. sent to trade fairs, exhibitions or tests.

It replaces the individual customs clearance declaration and in this case you do not receive the notification confirming export.

Thanks to it, you reduce the steps during clearance in the destination country and when the goods return to Poland.

You obtain the carnet on your own at the Polish National Chamber of Commerce, hand it to the courier at the time of shipment along with other documents.

Shipping is only possible to countries covered by the ATA Convention. It is not used when shipping goods for repair.

For carrying out the procedure we need:

- The ATA Carnet (hard copy)

- Your authorization for DHL Express to act as a representative (if you have not given us one before). The authorization form along with instructions can be found here

- Customs clearance order. Be sure to specify the purpose of the shipment. You can find the form

here

here

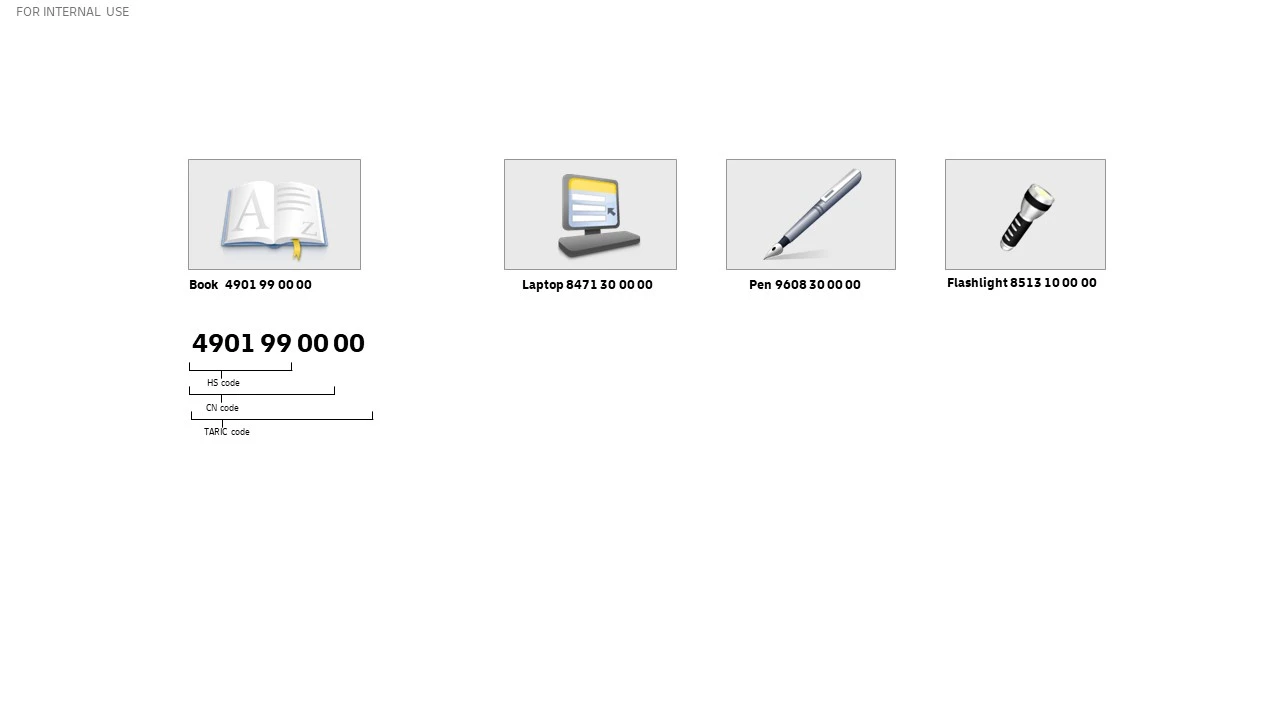

Comparison of the three options for exporting goods for temporary admission

|

|

INF3 |

Procedure 2300 |

The ATA |

|---|

| 1. Whether used for shipping to trade fairs, exhibitions and tests? | Yes | Yes | Yes |

| 2. Is it the exporter’s responsibility to obtain the document? | No | No | Yes |

| 3. Is an invoice required? | Yes | Yes | No |

| 4. Is identification of goods required? | Yes | Yes | Yes |

| 5. Is individual clearance required? | Yes | Yes | No |

| 6. Does the exporter receive the export notification? | Yes | Yes | No |

| 7. Are there facilitations for clearance in the destination country? | No | No | Yes |

| 8. What is the maximum time for the goods to return to Poland? | 36 mos | 36 mos | 36 mos |

| 9. Is it possible to apply for duty and tax exemption when the goods return to Poland? | Yes | Yes | Yes |

DOWNLOAD

DOWNLOAD DOWNLOAD

DOWNLOAD DOWNLOAD

DOWNLOAD DOWNLOAD

DOWNLOAD DOWNLOAD

DOWNLOAD DOWNLOAD

DOWNLOAD