Document name is based on the type of transaction

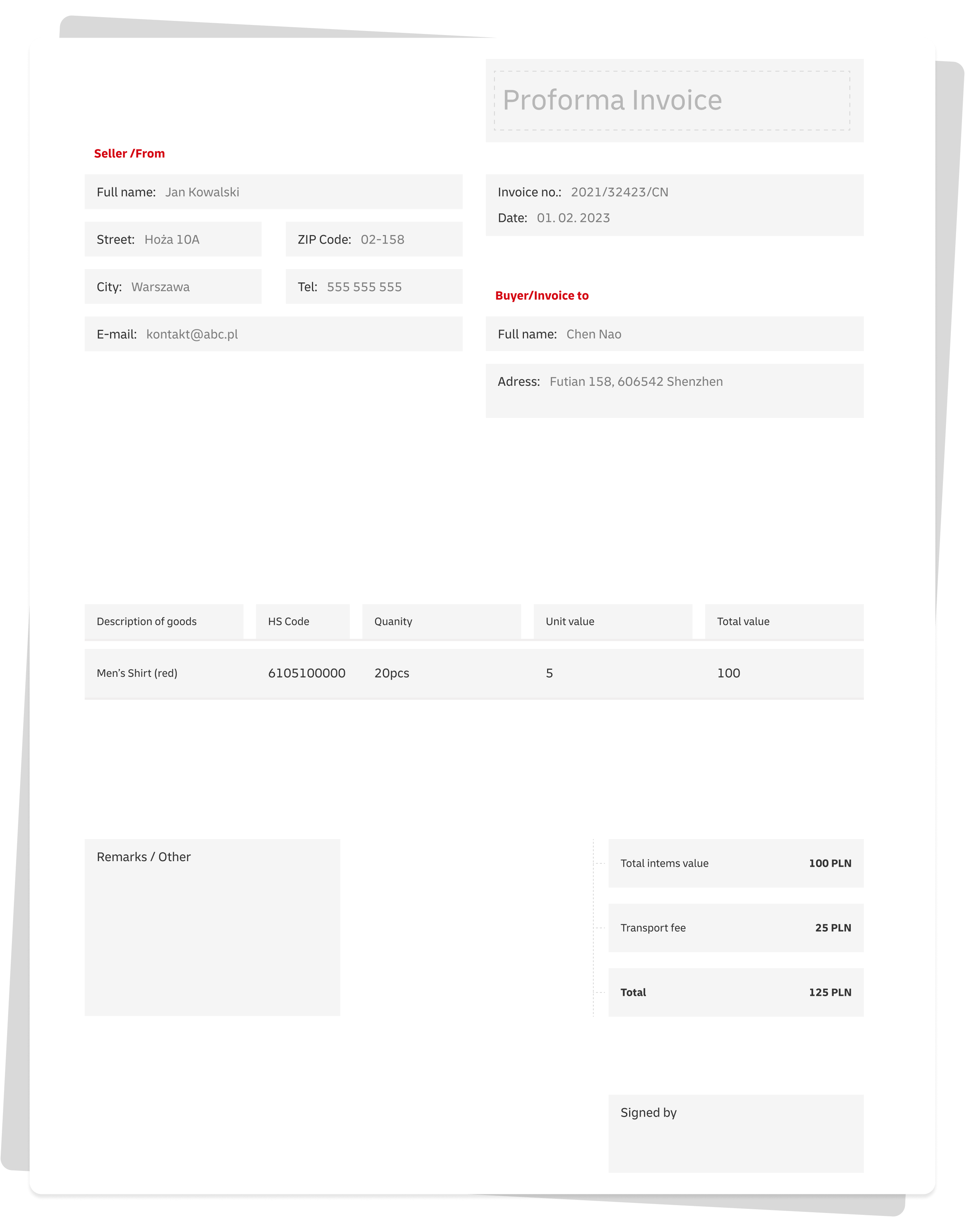

– purchase-sale transaction: invoice/commercial invoice

– free shipping of samples and designs: proforma invoice/non-commercial invoice

Authorization for DHL Express

If your parcel does not qualify for courier clearance or you asked for individual clearance, we need you to authorize us to represent you before the customs and revenue authorities.

You can find all the information about the authorization, forms and templates for filling it out here.

How to send us the authorization?

You will find the exact instructions on the first page of the authorization form.

To hasten the export customs clearance process you may also hand the original hard copy to our courier.